The "Anti-Lead-Gen" Strategy: Why Buying Leads is Killing Your Margins

The $50 Lead That Costs You $200

I've worked with dozens of home service (HVAC, Roofing, Plumbing, you name it) business owners who share the same quiet frustration.

Many times it’s difficult to articulate it, but they sense something is wrong — the margins get thinner every year, the leads get worse, and they're working harder to stay in the same place.

When you run the actual numbers, the feeling makes sense. The math is brutal. But understanding the math isn't enough — because if it were, every contractor would have stopped buying leads years ago.

The real question is why smart business owners stay stuck on a system they know isn't working. And that's where it gets interesting.

The Math That Nobody Runs

Here's what a typical lead purchase actually looks like.

You pay $65 for the chance to bid against four guys who are willing to work for half your price. The homeowner gets five calls within three minutes. You lower your quote to win the bid — because you're not competing on reputation anymore, you're competing on who picks up fastest and quotes lowest.

By the time you finish the job, you made less than you would have charging full rate to a customer who found you directly.

But most contractors never sit down and calculate the real cost-per-acquisition.

At $65 per lead with a 10% conversion rate, your cost per acquired customer is $650. That's before the margin compression from competitive bidding. Contractors report lowering quotes by 15-25% on aggregator leads just to win the work.

Take a $1,500 job. Discount 20% to win. You left $300 on the table — on top of the $650 you spent to acquire that customer. That $1,500 job just cost you $950 in acquisition and margin loss.

At 25-30% gross margin, you barely broke even. On a job you could have made $400+ on if the customer had found you directly.

And here's what makes it worse: the high-margin work never comes through aggregators. A 2 AM emergency water heater leak — the kind of call where homeowners will pay premium rates without blinking — those customers search Google directly. They need someone now. They're not filling out a form and waiting for five callbacks. The aggregator leads skew toward scheduled maintenance and price-shopping customers. The emergency calls, the ones with real margin, go to whoever shows up first in organic search.

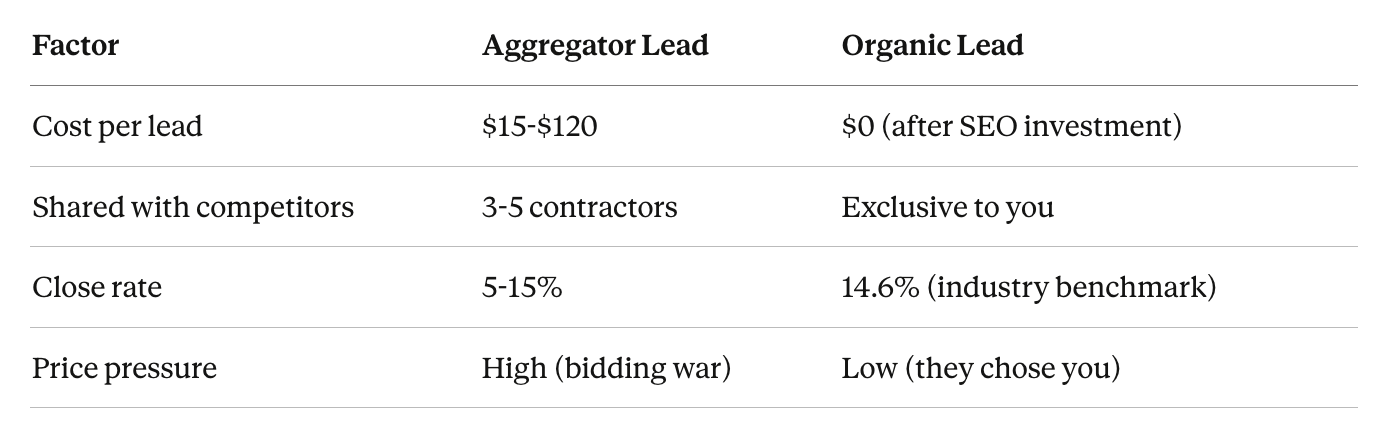

Aggregator Lead

Cost per lead - $15-$120

Shared with competitors - 3-5 contractors

Close rate - 5-15%

Price pressure - High (bidding war)

Organic Lead

Cost per lead - $0 (after SEO investment)

Shared with competitors - Exclusive to you

Close rate - 14.6% (industry benchmark)

Price pressure - Low (they chose you)

The 14.6% close rate for organic leads versus 5-15% for aggregator leads isn't opinion. It's what happens when customers find you versus when they're sent to you alongside four competitors.

The Dirty Secret Nobody Mentions

Here's something that should make you angry.

Search for your own business name right now. Open an incognito window first — that strips away the personalized results Google shows you because it knows you own the site. You'll see what your customers actually see.

If an aggregator's profile of you shows up above your own website, they are effectively charging you a toll to talk to people who were already looking for you.

That's not lead generation. That's a hostage situation.

The aggregators have spent years and millions of dollars building SEO authority. They rank for "[your service] [your city]" and for your actual business name. When a customer searches specifically for you — someone who already knows your company and wants to hire you — they click an aggregator result instead. Now you're paying $65 for a customer who was yours to begin with.

I see this in the backend of every Search Console I audit. Contractors losing clicks to aggregator profiles that exist only because the contractor signed up for the platform in the first place.

The platform used your business information to build a page that outranks you. And now they charge you to access customers who typed your name into Google.

The Number That Changes Everything

Most contractors think about the immediate job. The $1,500 repair. The $3,000 install.

But here's where the math shifts dramatically: Customer Lifetime Value.

A single plumbing customer who trusts you — who found your website because it answered their question, who read your reviews, who called you specifically — that customer is worth $4,000-$8,000 over five to six years. An HVAC customer? $13,000+ when you factor in the initial install, maintenance contracts, and eventual replacement.

I pulled these numbers from the backend analytics of contractors I've worked with over the past three years. Average repeat transactions run 5.1 per customer over the relationship lifespan. Repeat customers spend 67% more than new customers. And 43% of satisfied customers refer others.

A HomeAdvisor lead who chose you because you were cheapest? Maybe one job. Because when they need service again, they'll go back to the platform — not to you.

When you factor in lifetime value, you'd need to close five or six aggregator leads just to match the value of one organic relationship. At $65 per lead and 10% conversion, that's $3,250 in lead costs to achieve what organic search provides for the cost of maintaining your website.

This is why contractors who understand how organic leads actually convert make different decisions than contractors who only look at cost-per-lead.

Why Organic Leads Close Better

Aggregator leads are shopping. They submitted a form, received five calls, and they're comparing prices. They're conditioned to negotiate. The platform trained them to expect multiple options and pick the cheapest.

Organic leads are choosing. They searched "emergency plumber Phoenix." They saw your reviews. They read your service page. They called you. They've already decided you're the solution — they're just confirming.

I see this every time I dig into a contractor's call tracking data. The organic calls are shorter — not because the customer is rushed, but because there's less convincing to do. They already trust you. They just need to confirm availability and get a quote.

Recent 2025 benchmarks show this clearly. Organic leads close at 14.6%. Outbound and aggregator leads close at 1.7-15% depending on source. For every $1 spent on SEO, contractors average $19.90 return. For every $1 spent on paid or aggregator leads, average return is $4.40.

The gap isn't small. It's a 4.5x difference in return on investment.

And there's something else the data shows. SEO results compound. The contractor who invested in organic search in Year 1 continued generating leads in Year 2 without proportional cost increase. The contractor buying leads in Year 1 had to buy the same volume in Year 2 at the same — or higher — prices.

This is where building your Google Business Profile as a system starts to matter. And where content that answers what customers actually search becomes a competitive advantage rather than a nice-to-have.

The Asset vs. Rent Framework

Here's the mental model that clarifies the decision.

Buying leads is renting customers. You pay every month. If you stop paying, leads stop coming. You have no equity. You're dependent on someone else's platform and pricing decisions. And because customers find you through the platform, they stay connected to the platform — not to you.

Building organic search is owning an asset. You invest in your website, your Google Business Profile, your content. The work compounds. Rankings improve. Traffic grows. And when you stop investing, the asset doesn't disappear — it continues generating leads.

One contractor described it this way: "I spent $2,000 a month on HomeAdvisor for three years. That's $72,000. When I stopped paying, I had nothing to show for it. If I'd put that into SEO and content, I'd own a lead-generating machine."

And there's another difference that's easy to miss. When satisfied customers share referrals, they share your name and your website — not your aggregator profile. The organic customer becomes a source of more organic customers. The aggregator customer stays in the aggregator ecosystem.

The Objection Everyone Raises

"But SEO takes time."

This is true. And it's also why most contractors stay stuck on the aggregator treadmill.

SEO takes three to six months to show traction. Results accelerate from months six through twelve. By month twelve, organic lead flow often exceeds aggregator volume. By month twenty-four, cost-per-acquisition drops dramatically.

But here's what that timeline misses: the opportunity cost of delay.

Every month you postpone building organic infrastructure is another month of renting customers. The contractor who starts today is twelve months ahead of the contractor who starts next year. Aggregator prices increase over time. Organic assets appreciate over time.

The question isn't whether you can afford to invest in SEO. The question is whether you can afford not to — while paying $2,000 a month to platforms that keep raising prices.

What Actually Happens When You Build the Asset

Here's the trajectory I've seen play out with contractors who make the shift.

Year one: You invest in your website, GBP optimization, and local keyword strategy. Lead flow starts slow. You might still supplement with aggregators as a bridge.

Year two: Rankings improve. Organic leads increase. You reduce aggregator spend by 30-50%. The leads you're getting close faster and at higher margins.

Year three: Organic leads become your primary source. Aggregators become optional — something you use selectively for overflow, not survival. Your cost-per-acquisition drops 60-80%.

Year four and beyond: You're receiving leads that cost nearly nothing to acquire. Your competitors are still renting customers at escalating prices. You have something they don't — an asset you own.

The contractors who built SEO foundations three to five years ago aren't worried about HomeAdvisor pricing changes. They built something that survives platform shifts the same way it survives algorithm updates — because the foundation is real.

The Deeper Problem

Here's what most "stop buying leads" advice misses.

Contractors don't stay on aggregators because they're bad at math. They stay because the aggregator model feels safe. You pay, you get leads. The cause and effect is immediate. The risk feels contained.

Building organic search requires a different kind of thinking. You invest now for results later. You trust that the work compounds. You accept uncertainty in the short term for ownership in the long term.

This is uncomfortable. And when business owners are already stretched thin — managing crews, handling customers, keeping the trucks running — the aggregator's promise of "pay and receive" feels easier than "invest and build."

But easier isn't the same as better. And the contractors who push through the discomfort of building something they own end up in a fundamentally different position than the contractors who keep renting.

The math says invest. The gut says play it safe. The contractors I work with who break through are the ones who finally stop letting their gut dictate their growth.

A Reality Check

I need to be honest about something.

SEO isn't a magic wand. If you're 48 hours away from missing payroll, you should buy leads. Survival comes first. You can't build an asset if the business doesn't make it to next month.

Aggregators have a role — as a bridge, as overflow capacity, as a way to fill gaps while you build something better. They're not evil. They're just expensive rent that never turns into equity.

This approach works if you're generating $20K or more per month in revenue, tired of bidding wars and margin compression, and thinking three to five years ahead rather than thirty days. If you're ready to move from survival mode to building something that lasts.

For contractors still in survival mode: stabilize first. Get the trucks running. Make payroll. Then start building.

For contractors who are stable but stuck on the treadmill: the math is clear. Every month of delay is another month of paying someone else for customers you could be earning directly.

The contractors who asked this question three years ago aren't asking it anymore. They already know the answer.

Want to see what's actually holding back your organic leads?

Get a free Local SEO Audit — we'll show the three to five changes that can move your rankings and calls.